tennessee inheritance tax laws

If money is coming in then it is probably considered gross income under the Tennessee child support guidelines. Most states adhere to the Uniform Probate Code or UPC The UPC is a.

Kiddie Tax On Unearned Income H R Block

Nebraska had the highest inheritance tax at 18 for distant relations and non-related heirs but at least it doesnt impose an estate tax.

. Wills 32-1-104. What Is Income Under the Tennessee Child Support Guidelines. The department also assists with the collection of certain local taxes.

Generally if you conduct business within any county andor incorporated municipality in Tennessee then you should register for and remit business tax. Welcome to the Tennessee Law section of FindLaws State Law collection. Americas 1 tax preparation provider.

The Department of Revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws. Inheritance laws are statutes and regulations that determine how individuals receive assets from the estate of a deceased family member. Tennessee Code Title 32.

How Much is Inheritance Tax. Other Death Tax Changes by State. This will be especially important if you choose to exclude a family member from.

1 online tax filing solution for self-employed. This includes Social Security and income from retirement accounts. Wheres my Virginia Refund.

1-800-959-1247 email protected. Tennessee Code Title 31. Tennessee has one of the highest state and local sales taxes of any state with an.

About Tennessee tax details like Tennessee tax rates due dates and more. How Does Intestate Succession Work in Tennessee. The executor must file all tax returns and pay any taxes and other debts.

The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if you leave 10 or more of the net value to charity in your will. Information about those taxes is. Laws govern how the estate is handled and distributed.

Talk with an estate planning attorney in your state to understand how state inheritance laws may impact your estate plan. Tennessee Code Title 32. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

You can check the status of your Virginia refund 24 hours a day 7 days a week using our Wheres My Refund tool or by calling our automated phone line at 8043672486. Additionally property taxes in Tennessee are quite low with an average effective rate of just 064. This section contains user-friendly summaries of Tennessee laws as well as citations or links to relevant sections of Tennessees online statutesPlease select a topic from the list below to get started.

The state business tax and the city business tax. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more. Wills 32-1-105.

The law governing the waiver varies by state. Business tax consists of two separate taxes. This legal process can be quite complicated and it is important to understand how it works and what the requirements are.

Tennessee repealed its estate tax in 2016. Administration of Estates 30-2-301. The net value is the estates total value.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Probate is the method used to disperse the estate and satisfy any outstanding debts. What is Inheritance Tax.

Descent and Distribution 31-2-108. With a few exceptions all businesses that sell goods or services must pay the state business tax. State laws change frequently and the preceding information may not reflect recent changes.

That being said one tax that hits seniors in Tennessee especially hard is the sales tax. Tennessee Code Title 30. In some states individual inheritors are charged a state inheritance tax on top of federal.

To pay taxes you may do so online at https. Inheritance tax also called the estate tax or death tax is levied at both the federal level and state level and applies to any assets transferred to someone other than the deceaseds spouse at the time of death. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more.

Tax law does not matter. Read on to learn more. Self-Employed defined as a return with a Schedule CC-EZ tax form.

State tax ranges from business and sales tax to inheritance and gift tax. Within each tax type you will find the definition of the tax tax rates and due dates for returns. New York made significant changes to its estate tax laws in April 2014 by increasing the state exemption from 1 million to 20625 million for deaths occurring on or after April 1 2014 and before.

Surviving spouses ex-spouses children and grandchildren. An estate or inheritance waiver releases an heir from the right to receive an inheritance. Get a list of states without an estate or inheritance tax.

For Tennessee child support income can include amounts not listed on federal or state income tax returns such as interest on municipal bonds. Learn more about Probate Laws in your state. This article will discuss the inheritance rights of family members.

Tennessee established a similar law in 2010 while. Each state maintains its own laws governing the distribution of property left behind by those who died without leaving a valid will. Conflicting tax laws or changes in.

Inheritance Tax Laws in Texas. Most states have similar laws although some will vary more than others. How Long Does It Take to Get an Inheritance.

To reiterate inheritance succession varies from state to state.

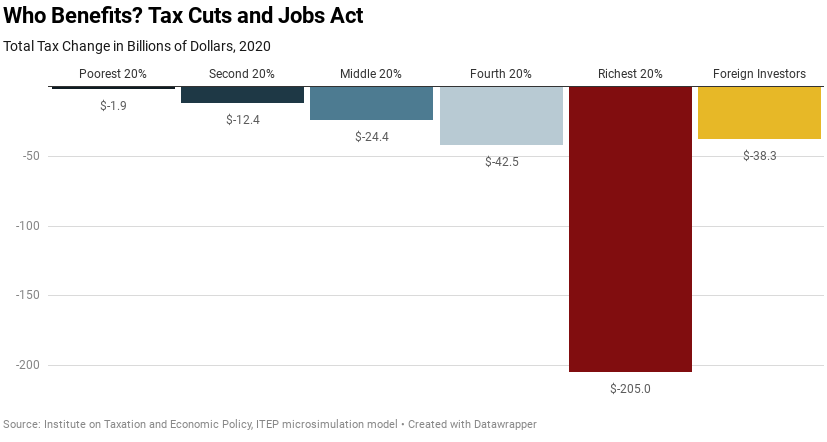

Updated Estimates From Itep Trump Tax Law Still Benefits The Rich No Matter How You Look At It Itep

The Capital Gains Dilemma Northern Trust

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Can Benford S Law Detect Tax Fraud

What Canadian Businesses Need To Know About U S Sales Tax

Major Changes To Estate And Inheritance Tax Laws Kizer Gammeltoft Brown P C

States Are Imposing A Netflix And Spotify Tax To Raise Money

How To Financially Protect Your Unmarried Partner In 2022 How To Plan Estate Planning Common Law Marriage

Supermarketmap Gif 756 429 Map Chart Bar Chart

Estate Planning Tax Rule You Should Know Batsonnolan Com

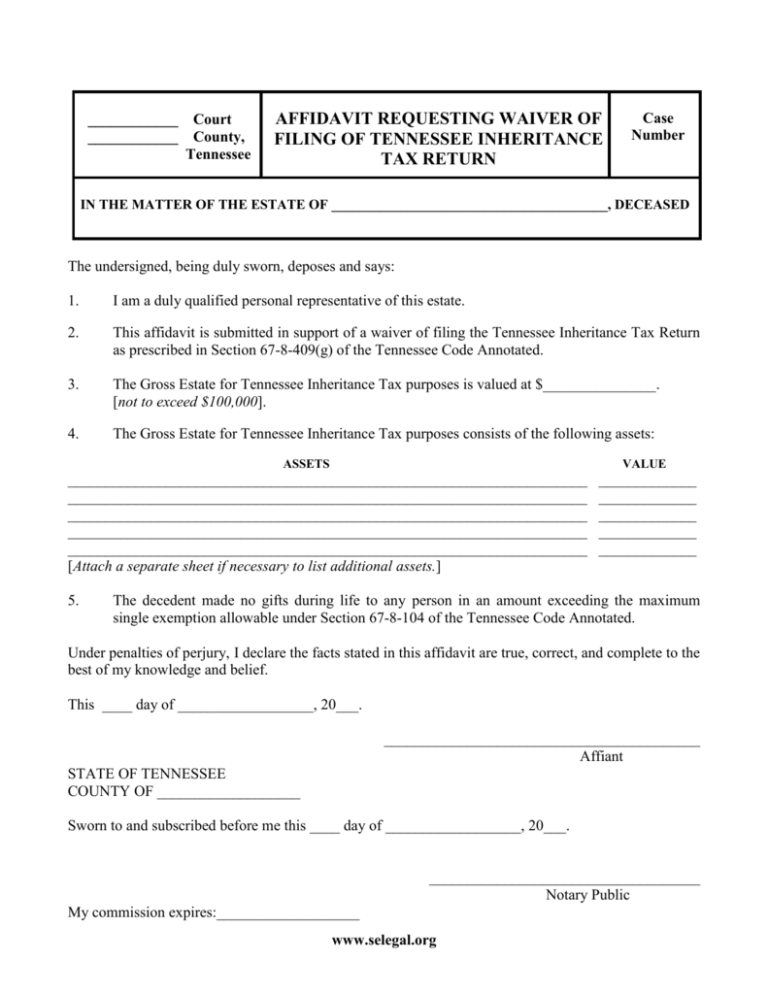

Affidavit Regarding Inheritance Tax Return

How Do State And Local Individual Income Taxes Work Tax Policy Center