child tax credit december 2021 amount

The irs sent the last child tax credit payment for december 15 2021. The age limit was 16 in 2020.

Lets say you qualified for the full 3600 child tax credit in 2021.

. This amount represents half of the full amount of the Child Tax Credit with the other half to be received at tax time. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older. For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child.

The American Rescue Plan increased that 2000 per child to 3000 and to 3600 if your child was younger than age 6. These payments may be made in advance and reflect a portion of the tax year 2021 Child Tax Credit rather than receiving this credit as part of your return in 2022. Child Tax Credit Amount for 2021.

Between July 15 and December 31 2021 39 million households with 65 million children 88 of children in the United States automatically received monthly payments of between 250 and 300. The American Rescue Plan Act ARPA expanded the credit from a maximum of 2000 to 3600 for eligible children. The Child Tax Credit provides money to support American families.

If you paid for care of 2 or. You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return. And 3000 for children ages 6 through 17 at the end of 2021.

Eligible families may get a 300 monthly advance payment of their 2021 Child Tax Credit for each child under the age of six and a 250 monthly advance payment for each child aged six and older. Specifically the Child Tax Credit was revised in the following ways for 2021. Families will receive the other half when they submit their 2021 tax return next season.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are. Treasury will make the payments for periods between July 1 and December 31 2021. For example monthly payments could be up to 250 per qualifying child 300 per qualifying child under age 6.

The percentages will change according to your income. Here is some important information to understand about this years Child Tax Credit. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim on your 2021 tax return during the 2022 tax filing season.

The plan also made the credit fully refundable and provided tax credit options for families to take half the credit in six monthly payments. For the paid care of a single qualifying person the limit of the allowable expense is 3000. For 2021 the child tax credit is fully refundable.

You may claim the remaining amount of your 2021 Child Tax. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. That comes out to 300 per month through the end of 2021 and.

When you file your taxes for 2021 in 2022 you will receive the other half of the benefit. 3600 for children ages 5 and under at the end of 2021. The plan provided up to 1800 for children age five and under and 1500 for children age six to 17 to be distributed in chunks of 250 per child or 300 per child depending on age from July 2021 through December 2021.

The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. This impacted tens of millions of families who received up to 300 per child each. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

You have a balance of 6900 for your older children plus 3600 for the newborn which makes a total of 10500. As much as 35 of allowable expenses is what the credit would be worth. The payments are part of the 19 trillion.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6. 300 total youll receive each month from July to December 2021 For every eligible kid you have age 6 - 17. Parents with 2021 modified AGI no greater than 40000 single filers 50000 head-of-household filers or60000 joint filers wont.

250 total youll receive each month from July to December 2021 Lets look at some possible examples to. The Child Tax Credit allowed you to deduct 2000 for each qualifying child dependent under age 17 under the terms in place in tax years 2018 through 2020. Some families received half of their estimated 2021 child tax credit from July through December 2021.

Child tax credit for baby born in December 21 The total child tax credit of 10500 is correct. If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. For parents with children 6-17 the payment for December will be 250.

Wait 5 working days from the payment date to contact us. For every eligible kid you have age 0 - 5. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

For 2021 the child tax credit amount increases from 2000 to 3000 per qualifying child 3600 per qualifying child under age 6. As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments only going to families that earned enough income to owe taxes. The credit amount was increased for 2021.

Tax Changes And Key Amounts For The 2022 Tax Year.

H R Block 2018 Online Review The Best Option For Free File Hr Block Free Tax Filing Tax Refund

Pin On Children S School Events

Don T Delay Get Your Health Covered Today Health Plan Affordable Health Health

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Due Dates For Filing Gstr 3b For December 2020 Due Date Dating Business Advisor

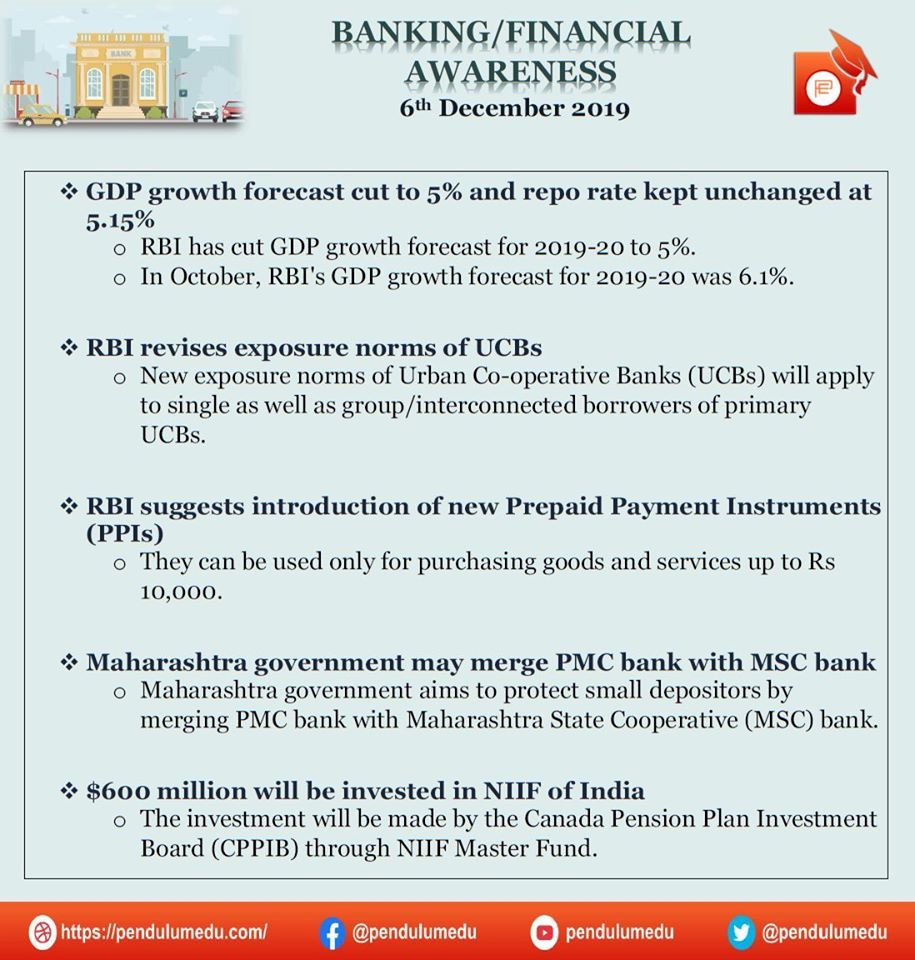

Pin On Banking Financial Awareness

Pin On An Expat S Guide To Singapore

Pin On Banking Financial Awareness

How To Read A Balance Sheet Balance Sheet Template Business Plan Template Online Business Plan Template

Banking Financial Awareness 14th January 2020 Awareness Banking Financial

Generate Rent Receipt By Filing In The Required Details Print The Receipt Get The Receipt Stamped Signed By Landlord Sub Free Tax Filing Filing Taxes Rent

Pin On Stagecoach Payroll Solutions

Daily Banking Awareness 20 21 And 22 December 2020 Awareness Banking Financial

Find The List Of All The Important Due Dates For Gst Compliance For The Month Of April 2021 Make Sure That You File Y Indirect Tax Billing Software Due Date